CHAPTER 11 CLIENTS | BANKRUPTCY PROCESS

For Tran Singh LLP, easing the burden of the bankruptcy process by providing valuable resources and information to our clients, is a top priority. We endeavor to accomplish that by making as much valuable information available online to you 24/7.

For our Chapter 11 clients, we have provided below the bankruptcy process steps of which you should be aware, including deadlines, responsibilities, obligations and additional information, requirements and resources.

For our Chapter 11 clients, we have provided below the bankruptcy process steps of which you should be aware, including deadlines, responsibilities, obligations and additional information, requirements and resources.

PROCESS AND STEPS BEFORE FILING FOR CHAPTER 11 BANKRUPTCY

The initial process and steps before filing for Chapter 11 Bankruptcy are as follows:

Each of the foregoing is described on Bankruptcy Process | New Clients and we would refer you to such page for more detailed information with respect to those matters that occur up to the filing of your Chapter 11 bankruptcy case.

- Schedule Initial Consultation

- Pre-Consultation Documentation and Information

- Attend Initial Consultation Meeting

- Establish MyCase Client Portal Account

- Complete Pre-Filing Mandatory Credit Counseling (if the debtor is an individual (or husband and wife))

- Return Outstanding Documentation and Information to Complete Preparation of Required Bankruptcy Filings

- Following the Preparation of the Required Bankruptcy Filings, Client Returns to Review and Sign Bankruptcy Filings

- Bankruptcy Petition Filed

Each of the foregoing is described on Bankruptcy Process | New Clients and we would refer you to such page for more detailed information with respect to those matters that occur up to the filing of your Chapter 11 bankruptcy case.

FEDERAL INCOME TAX RETURNS (INDIVIDUAL & BUSINESS DEBTORS)

In accordance with § 521(f) of the Bankruptcy Code, all Chapter 11 debtors must file, and provide copies to the U.S. Trustee, the 3 most recent years of the debtor's federal tax returns.

To obtain a tax return transcript, please see the options below:

To obtain a tax return transcript, please see the options below:

- Online—Go to www.irs.gov/transcript to download a copy of your tax return transcript immediately.

- Mail—You can elect the option to Get Transcript by Mail at www.irs.gov/transcript or complete and mail either a Form 4506-T, Request for Transcript of Tax Return, or Form 4506T-EZ, Short Form Request for Individual Tax Return Transcript.

- Call—1-800-908-9946 and follow the voice prompts.

- In Person—You can also file your unfiled federal tax returns at any of the following offices:

Houston (Downtown) |

Monday—Friday 8:30 a.m. to 4:30 p.m. |

Office Information (281) 721-7021 |

Make Appointment (844) 545-5640 |

|

Houston (NW) |

Monday—Friday 8:30 a.m. to 4:30 p.m. |

Office Information (713) 209-5499 |

Make Appointment (844) 545-5640 |

|

Houston (SE) |

Monday—Friday 8:30 a.m. to 4:30 p.m. |

Office Information (281) 721-7021 |

Make Appointment (844) 545-5640 |

|

Houston (SW) |

Monday—Friday 8:30 a.m. to 4:30 p.m. |

Office Information (281) 721-7021 |

Make Appointment (844) 545-5640 |

INITIAL DEBTOR INTERVIEW

Debtors are required to attend, if a business debtor, through senior management, and with counsel an Initial Debtor Interview ("IDI") with a case analyst assigned by the U.S. Trustee. The purpose of the IDI is to familiarize the U.S. Trustee with the Debtor's business and operations, any business associations of the Debtor, the reason for filing the Chapter 11 bankruptcy, any issues in the case, and to explain the Debtor's plan to successfully emerge from Chapter 11 bankruptcy.

The IDI is generally held within approximately ten (10) days of the filing of the Chapter 11 petition and the U.S. Trustee will mail and e-mail a notification letter to debtor's counsel as well as mail a hard copy to the Debtor.

Pursuant to the Federal Rules of Bankruptcy Procedure 2015, the U.S. Trustee requires that each Chapter 11 debtor complete and submit an Initial Report to the U.S. Trustee no later than five (5) days prior to the IDI. Please complete this Initial Report and return to your attorney at Tran Singh LLP for submission to the U.S. Trustee.

Additional documents you will want to access, review and save are:

Additional compliance documents that will be required to be e-mailed to the U.S. Trustee includes the following:

The IDI is generally held within approximately ten (10) days of the filing of the Chapter 11 petition and the U.S. Trustee will mail and e-mail a notification letter to debtor's counsel as well as mail a hard copy to the Debtor.

Pursuant to the Federal Rules of Bankruptcy Procedure 2015, the U.S. Trustee requires that each Chapter 11 debtor complete and submit an Initial Report to the U.S. Trustee no later than five (5) days prior to the IDI. Please complete this Initial Report and return to your attorney at Tran Singh LLP for submission to the U.S. Trustee.

Additional documents you will want to access, review and save are:

- Approved Depositories

- Quarterly Fee Disbursement and Information and Instructions

- Disclosure of Intent to Use Taxpayer Identification Number

- Notice of Interest Assessment

- Quarterly Fee Form UST 11A

Additional compliance documents that will be required to be e-mailed to the U.S. Trustee includes the following:

- Complete copies of the three (3) most recent years federal income tax returns as filed with the IRS. You must also provide the U.S. Trustee's office with a copy of any federal income tax return or extension filed during the pendency of your Chapter 11 case.

- Complete copies of the three (3) most recent months State Sales Tax Returns.

- You may be asked to provide copies of personal and real property tax statements for the last three (3) years, and you may also be asked to provide the three most recent 941 tax returns filed with the IRS.

- The most recent financial statements, audited as well as unaudited, including, but not limited to, balance sheets, profit and loss statements, inventory statements and tax reconciliations for the last three (3) years.

- If a debtor in possession is a corporation, provide a copy of a corporate resolution authorizing the filing of the Chapter 11 petition and designating an individual to sign pleadings.

- If a debtor in possession is a partnership, provide a copy of the written agreement to the filing of the bankruptcy case signed by all partners, or by all general partners if the debtor in possession is a limited partnership.

INSURANCE REQUIREMENTS

All debtors must maintain insurance and pay all premiums as they come due. The U.S. Trustee shall be identified as a party to be notified of any change, cancellation or expiration of each policy. A ten (10) day advance notice is the minimum requirement. However, thirty (30) days should be requested of the insurance company.

Unless the U.S. Trustee otherwise directors or the debtor obtains a Court waiver, the debtor must maintain insurance customary in the debtor's business as well as the following:

The Debtor must provide the U.S. Trustee proof that the required insurance is being maintained throughout the pendency of the Chapter 11 case by providing the U.S. Trustee a copy of the Declarations page of the insurance policy. Should an insurance policy expire during the pendency of the Chapter 11 case, upon expiration, termination or renewal of any coverage, the debtor shall immediately provide the U.S. Trustee with adequate proof of renewal or replacement coverage.

Unless the U.S. Trustee otherwise directors or the debtor obtains a Court waiver, the debtor must maintain insurance customary in the debtor's business as well as the following:

- If the debtor has tangible assets susceptible to casualty loss (fire, weather, theft, vandalism, etc.), casualty insurance must be maintained;

- If the debtor has employees, workers' compensation insurance, or sufficient equivalent coverage, must be maintained, unless the debtor obtains an order of the court waiving this requirement; and

- If the debtor conducts business operations, general liability and, if appropriate, product liability insurance must be maintained.

The Debtor must provide the U.S. Trustee proof that the required insurance is being maintained throughout the pendency of the Chapter 11 case by providing the U.S. Trustee a copy of the Declarations page of the insurance policy. Should an insurance policy expire during the pendency of the Chapter 11 case, upon expiration, termination or renewal of any coverage, the debtor shall immediately provide the U.S. Trustee with adequate proof of renewal or replacement coverage.

INFORMATION REGARDING BANK ACCOUNTS

Upon the filing of the bankruptcy petition, the debtor shall immediately close all bank accounts over which the debtor has possession or control at the time of filing.

The debtor shall immediately open new debtor bank accounts at a depository approved by the U.S. Trustee. Please refer to the U.S. Trustee's Approved Depositories. The new accounts are the Operating Account and, if payroll or other taxes are an issue for the debtor, the Tax Account. If required by court order, a separate cash collateral account must be established and maintained. If required by court order, a separate cash collateral account must be established and maintained. If the debtor has a separate payroll account pre-petition, this account should also be closed and a new payroll account should be opened. The debtor must have court approval of any request for an exemption from the U.S. Trustee policy regarding the use of a depository not approved by the U.S. Trustee.

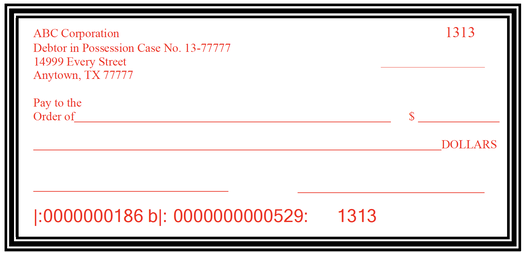

The debtor shall ensure that the depository imprints the full name of the debtor, including any d/b/a's, the designation "Debtor in Possession" (NOT D.I.P.), and the debtor's bankruptcy case number on all permanent checks used for the new bank accounts. The debtor must type or print all of the foregoing information on temporary checks. The new account signature cards shall clearly indicate that the debtor is a "Chapter 11 Debtor in Possession" and show the bankruptcy case number. An example is provided below for your reference.

The debtor shall immediately open new debtor bank accounts at a depository approved by the U.S. Trustee. Please refer to the U.S. Trustee's Approved Depositories. The new accounts are the Operating Account and, if payroll or other taxes are an issue for the debtor, the Tax Account. If required by court order, a separate cash collateral account must be established and maintained. If required by court order, a separate cash collateral account must be established and maintained. If the debtor has a separate payroll account pre-petition, this account should also be closed and a new payroll account should be opened. The debtor must have court approval of any request for an exemption from the U.S. Trustee policy regarding the use of a depository not approved by the U.S. Trustee.

The debtor shall ensure that the depository imprints the full name of the debtor, including any d/b/a's, the designation "Debtor in Possession" (NOT D.I.P.), and the debtor's bankruptcy case number on all permanent checks used for the new bank accounts. The debtor must type or print all of the foregoing information on temporary checks. The new account signature cards shall clearly indicate that the debtor is a "Chapter 11 Debtor in Possession" and show the bankruptcy case number. An example is provided below for your reference.

The debtor must deposit all receipts into and make disbursements only from the approved Debtor in Possession account(s). Any funds in excess of that required for current operations should be maintained in an interest-bearing Debtor-in-Possession account.

The debtor shall deposit to the Tax Account sufficient funds to pay all tax liabilities (when incurred).

All funds held by the bankruptcy estate must be deposited into an account with an Approved Depository financial institution that agrees to comply with the requirements of the U.S. Trustee and is so designated by the U.S. Trustee. The U.S. Trustee will monitor Debtor-in-Possession accounts in the Approved Depository and the Debtor-in-Possession accounts shall not exceed the insured or collateralized limits of that approved depository.

The U.S. Trustee may request the debtor provide copies of bank statements for pre-petition bank accounts and/or post-petition Debtor-in-Possession bank accounts. Additionally, the U.S. Trustee may request copies of supporting documentation for transactions disclosed in the bank statements. If the bank statements or supporting documentation, e.g., deposit slips, cancelled checks, are not available to the debtor, the debtor agrees to provide consent for the U.S. Trustee to request copies of bank statements and/or supporting documentation directly from the debtor's financial institution(s).

The debtor shall deposit to the Tax Account sufficient funds to pay all tax liabilities (when incurred).

All funds held by the bankruptcy estate must be deposited into an account with an Approved Depository financial institution that agrees to comply with the requirements of the U.S. Trustee and is so designated by the U.S. Trustee. The U.S. Trustee will monitor Debtor-in-Possession accounts in the Approved Depository and the Debtor-in-Possession accounts shall not exceed the insured or collateralized limits of that approved depository.

The U.S. Trustee may request the debtor provide copies of bank statements for pre-petition bank accounts and/or post-petition Debtor-in-Possession bank accounts. Additionally, the U.S. Trustee may request copies of supporting documentation for transactions disclosed in the bank statements. If the bank statements or supporting documentation, e.g., deposit slips, cancelled checks, are not available to the debtor, the debtor agrees to provide consent for the U.S. Trustee to request copies of bank statements and/or supporting documentation directly from the debtor's financial institution(s).

U.S. TRUSTEE MONTHLY OPERATING REPORTS

Pursuant to the Federal Rules of Bankruptcy Procedure 2015, the debtor must file monthly operating reports with the Bankruptcy Court. All monthly operating reports must be filed no later than the twenty-first (21st) day of the month following the end of the month covered by the report. The debtor must file a financial report every month using the reporting forms designated by the U.S. Trustee, beginning with the filing date and ending on the date of dismissal or conversion to another chapter of the bankruptcy code.

Debtors may file post-confirmation reports beginning in the quarter following plan confirmation. The post-confirmation reports must be filed no later than the twenty-first (21st) day of the month following the end of the quarter covered by the report.

The types of Monthly Operating Reports are as follows:

Debtors may file post-confirmation reports beginning in the quarter following plan confirmation. The post-confirmation reports must be filed no later than the twenty-first (21st) day of the month following the end of the quarter covered by the report.

The types of Monthly Operating Reports are as follows:

- Small Business Debtor

- Non-Small Business Debtor

- Individual Wage Earner (no business)

- Individual Wage Earner (including business)--Both Report 1 and Report 2

- Post Confirmation Debtor

PREPARING FOR YOUR MEETING OF CREDITORS | 341 MEETING

In accordance with § 341(a) of the Bankruptcy Code requires a meeting of creditors, often referred to as the 341 Meeting, in each case within sixty (60) days of the petition date. Notice of the meeting is sent to all creditors. The debtor, or, for a business debtor, a representative (customarily an officer) of the debtor, and counsel for the debtor are required to attend. For a business debtor, the debtor's representative should have knowledge of and be familiar with the operation of the Debtor's business and the bankruptcy proceeding. In addition, the financial person for the debtor should be available for examination at the 341 Meeting. For individual debtors in a joint case, both debtors should be present to testify at the 341 Meeting.

If the debtor's first monthly operating report is due prior to the 341 Meeting, the debtor must file the operating report(s) and send a copy to the U.S. Trustee by the due date.

You should anticipate that the U.S. Trustee will ask a series of standard questions such as the following (which is not intended to be an exact or exhaustive list and questions may vary from those stated below):

The U.S. Trustee may ask additional, more specific questions about your financial condition and operations as well as matters disclosed in your bankruptcy filings.

It is normal to feel apprehension surrounding your 341 Meeting. To help ease those worries, we’ve provided steps below to help you prepare for your 341 Meeting and to feel comfortable and confident at your 341 Meeting. In addition to those reminders provided below, we recommend that you review your bankruptcy schedules, which were filed with your bankruptcy petition, and sets forth, among others, your assets and liabilities, executory contracts and unexpired leases (if applicable), and income and expenses. On the day of your scheduled 341 Meeting, please be mindful to select appropriate clothing. Although your 341 Meeting will not be held in a courtroom, it is a legal proceeding and you should dress accordingly. Casual clothing such as t-shirts, shorts, jeans or sandals are frowned upon. Similarly, you should not wear a business suit or dress which will draw unnecessary attention. The best choice would be to select business casual clothing such as slacks and a collared shirt for men, and, for women, either pants or skirt with a conservative top. Additionally, we would recommend that any expensive jewelry be left at home and not worn or brought to your meeting. And, for electronic devices, we ask that if you cannot leave them at home, you keep them on silent, in your pocket or, for women, in your purse, until the conclusion of the 341 Meeting.

During the 341 Meeting we encourage you to relax. Remember that nearly every debtor who attends a 341 Meeting frequently observes that they were surprised that the process was quick and painless. Be sure to address the Chapter 11 Trustee with respect and listen carefully to his or her questions. If you find it helpful, use the notepad and pen you brought to write down the questions. Answer only the question asked and do not volunteer information. Do not try to explain or justify answers. If you don’t know the answer to a question, let your attorney assist you or speak for you. Most importantly—answer truthfully—you are under oath and being recorded. Do not make any agreement with the Chapter 11 Trustee prior to consulting with your attorney. At the conclusion of your 341 Meeting, be sure that you’ve written down any items that you will be required to provide to your Chapter 11 Trustee. Speak with your attorney before you leave to ensure you are aware of any responsibilities, in addition to those instructed by the Chapter 11 Trustee, that you may have.

Your participation at the 341 Meeting is generally less than an hour. Creditors or other interested parties in your case rarely attend this meeting. By spending a few minutes preparing for your meeting, you can reduce your stress and ensure that your meeting goes smoothly.

If the debtor's first monthly operating report is due prior to the 341 Meeting, the debtor must file the operating report(s) and send a copy to the U.S. Trustee by the due date.

You should anticipate that the U.S. Trustee will ask a series of standard questions such as the following (which is not intended to be an exact or exhaustive list and questions may vary from those stated below):

- Did you review and read the bankruptcy petition and schedules?

- Was the information contained in the petition and schedules accurate when signed?

- Has anything changed since the petition was filed?

- Did you list all of your creditors?

- Have you made any payments during the past year?

- Are you involved in a lawsuit?

- Are you entitled to receive any insurance proceeds?

- Does anyone owe you money?

The U.S. Trustee may ask additional, more specific questions about your financial condition and operations as well as matters disclosed in your bankruptcy filings.

It is normal to feel apprehension surrounding your 341 Meeting. To help ease those worries, we’ve provided steps below to help you prepare for your 341 Meeting and to feel comfortable and confident at your 341 Meeting. In addition to those reminders provided below, we recommend that you review your bankruptcy schedules, which were filed with your bankruptcy petition, and sets forth, among others, your assets and liabilities, executory contracts and unexpired leases (if applicable), and income and expenses. On the day of your scheduled 341 Meeting, please be mindful to select appropriate clothing. Although your 341 Meeting will not be held in a courtroom, it is a legal proceeding and you should dress accordingly. Casual clothing such as t-shirts, shorts, jeans or sandals are frowned upon. Similarly, you should not wear a business suit or dress which will draw unnecessary attention. The best choice would be to select business casual clothing such as slacks and a collared shirt for men, and, for women, either pants or skirt with a conservative top. Additionally, we would recommend that any expensive jewelry be left at home and not worn or brought to your meeting. And, for electronic devices, we ask that if you cannot leave them at home, you keep them on silent, in your pocket or, for women, in your purse, until the conclusion of the 341 Meeting.

During the 341 Meeting we encourage you to relax. Remember that nearly every debtor who attends a 341 Meeting frequently observes that they were surprised that the process was quick and painless. Be sure to address the Chapter 11 Trustee with respect and listen carefully to his or her questions. If you find it helpful, use the notepad and pen you brought to write down the questions. Answer only the question asked and do not volunteer information. Do not try to explain or justify answers. If you don’t know the answer to a question, let your attorney assist you or speak for you. Most importantly—answer truthfully—you are under oath and being recorded. Do not make any agreement with the Chapter 11 Trustee prior to consulting with your attorney. At the conclusion of your 341 Meeting, be sure that you’ve written down any items that you will be required to provide to your Chapter 11 Trustee. Speak with your attorney before you leave to ensure you are aware of any responsibilities, in addition to those instructed by the Chapter 11 Trustee, that you may have.

Your participation at the 341 Meeting is generally less than an hour. Creditors or other interested parties in your case rarely attend this meeting. By spending a few minutes preparing for your meeting, you can reduce your stress and ensure that your meeting goes smoothly.

ATTENDING YOUR MEETING OF CREDITORS | 341 MEETING

During the 341 Meeting, the U.S. Trustee, or a member of the staff, will preside at the 341 Meeting, administer the oaths, and examine the debtor and/or other appropriate person(s). Creditors, equity holders and other interested parties may attend the 341 Meeting and ask questions. This meeting is recorded and conducted under oath and penalty of perjury. The debtor must answer questions regarding his or her financial affairs and the terms of the proposed Chapter 11 Plan of Reorganization (the "Chapter 11 Plan"). If a husband and wife file a joint petition, they must both attend the 341 Meeting and answer questions. In order to preserve their independent judgment, bankruptcy judges are prohibited from attending the 341 Meeting. The parties typically resolve problems with the Chapter 11 Plan, if any, either during or shortly after the 341 Meeting.

Consistent with any and all other hearing dates set for your case, you will be notified of the 341 Meeting by the bankruptcy court via first class mail. We will also notify you of this hearing date and it will appear as a calendared event in your MyCase Client Portal.

After notice of the 341 Meeting has been mailed, meetings cannot be canceled or rescheduled to accommodate conflicts with schedules. Work or family commitments are not satisfactory excuses for missing your scheduled 341 Meeting.

**Due to the COVID-19 global pandemic, all 341 Meetings are being held telephonically. Please refer to the Instructions for Participants in Telephonic 341 Meetings.

Consistent with any and all other hearing dates set for your case, you will be notified of the 341 Meeting by the bankruptcy court via first class mail. We will also notify you of this hearing date and it will appear as a calendared event in your MyCase Client Portal.

After notice of the 341 Meeting has been mailed, meetings cannot be canceled or rescheduled to accommodate conflicts with schedules. Work or family commitments are not satisfactory excuses for missing your scheduled 341 Meeting.

**Due to the COVID-19 global pandemic, all 341 Meetings are being held telephonically. Please refer to the Instructions for Participants in Telephonic 341 Meetings.

On the day of your 341 Meeting, please make note of the following:

- You will need at least $12.00 in cash to pay for parking.

- Plan to arrive at least 20 minutes prior to your scheduled meeting - DO NOT BE LATE.

- Expect the meeting to take a minimum of 30 minutes.

- Upon arrival, have a seat in the waiting area, you do not need to sign in; your attorney will meet you at the courthouse. Do not be alarmed if you do not see the attorney upon arrival, sometimes they are held up in other courtrooms, but do not worry, one of the attorneys will be there before your meeting begins.

QUARTERLY FEES

Debtors are required to pay a quarterly fee to the U.S. Trustee. Quarterly fees must be paid for every calendar quarter, or a part of a quarter, in which the Chapter 11 case is pending until the date of entry of an order closing, dismissing or converting the case. If a case is pending as a Chapter 11 case for even one (1) day during a quarter, payment of the fee for that quarter is required. Thus, there is no proration of the U.S. Trustee quarterly fee.

If a Chapter 11 case has been jointly administered with another case or has been consolidated with other cases for administrative purposes only, quarterly fees will accrue in each case and the debtor is responsible for payment of the quarterly fees assessed in each of the individual cases. If the court has ordered the case to be substantively consolidated (consolidated for all purposes), then quarterly fees will accrue only in the main case number. However, the debtor is responsible for the payment of quarterly fees accrued in each of the individual cases prior to the entry of the order of consolidation.

The amount of the quarterly fee depends upon the dollar amount of the debtor's disbursements during each calendar quarter. A minimum fee of $325.00 is due each quarter even if no disbursements are made during that quarter. Please refer to the U.S. Trustee Quarterly Fees.

U.S. Trustee fees are to be paid according to the following schedule:

If a Chapter 11 case has been jointly administered with another case or has been consolidated with other cases for administrative purposes only, quarterly fees will accrue in each case and the debtor is responsible for payment of the quarterly fees assessed in each of the individual cases. If the court has ordered the case to be substantively consolidated (consolidated for all purposes), then quarterly fees will accrue only in the main case number. However, the debtor is responsible for the payment of quarterly fees accrued in each of the individual cases prior to the entry of the order of consolidation.

The amount of the quarterly fee depends upon the dollar amount of the debtor's disbursements during each calendar quarter. A minimum fee of $325.00 is due each quarter even if no disbursements are made during that quarter. Please refer to the U.S. Trustee Quarterly Fees.

U.S. Trustee fees are to be paid according to the following schedule:

Quarter |

Months |

Quarter Ending |

Quarterly Fee Due Date for Payment |

1st Quarter |

January / February / March |

March 31 |

April 30 |

2nd Quarter |

April / May / June |

June 30 |

July 31 |

3rd Quarter |

July / August / September |

September 30 |

October 31 |

4th Quarter |

October / November / December |

December 31 |

January 31 |

A Chapter 11 Plan must provide for payment of all unpaid quarterly fees as of its effective date, or it cannot be confirmed. Failure to include provisions for payment of post-confirmation quarterly fees in the Chapter 11 Plan will result in the U.S. Trustee filing objections to confirmation of the Chapter 11 Plan.

Each debtor or other designated party will receive a statement for each calendar quarter regarding the fee prior to each of the due dates.

Please note that payment options include paying the Chapter 11 quarterly fees Online. Alternatively, if paying by check, the check must be made payable to "United States Trustee" and be accompanied by a completed Quarterly Fee Payment Coupon.

The address to use to mail quarterly fee payments is:

United States Trustee Payment Center

P.O. Box 6200-19

Portland, OR 97228-6200

The address to use for overnight delivery is:

U.S. Bank

Attn: Government Lockbox - U.S. Trustee Payment Center 6200-19

17650 N.E. Sandy Blvd.

Portland, OR 97230-5000

Failure to pay the quarterly fee is cause for conversion or dismissal of a Chapter 11 case. Further, the U.S. Trustee intends to use the debtor's taxpayer identification number for the purpose of collecting and reporting delinquent quarterly fees to the Department of Treasury pursuant to the Debt Collection Improvements Act of 1996.

Each debtor or other designated party will receive a statement for each calendar quarter regarding the fee prior to each of the due dates.

Please note that payment options include paying the Chapter 11 quarterly fees Online. Alternatively, if paying by check, the check must be made payable to "United States Trustee" and be accompanied by a completed Quarterly Fee Payment Coupon.

The address to use to mail quarterly fee payments is:

United States Trustee Payment Center

P.O. Box 6200-19

Portland, OR 97228-6200

The address to use for overnight delivery is:

U.S. Bank

Attn: Government Lockbox - U.S. Trustee Payment Center 6200-19

17650 N.E. Sandy Blvd.

Portland, OR 97230-5000

Failure to pay the quarterly fee is cause for conversion or dismissal of a Chapter 11 case. Further, the U.S. Trustee intends to use the debtor's taxpayer identification number for the purpose of collecting and reporting delinquent quarterly fees to the Department of Treasury pursuant to the Debt Collection Improvements Act of 1996.

DISCLOSURE STATEMENT, CHAPTER 11 PLAN AND CONFIRMATION OF CHAPTER 11 PLAN

The debtor must file and get court approval of a written disclosure statement before there can be a vote on the Chapter 11 Plan. The disclosure statement must provide adequate information concerning the affairs of the debtor to enable the holder of a claim or interest to make an informed judgment about the Chapter 11 Plan and whether to vote to accept or reject the Chapter 11 Plan. After the disclosure statement is filed, the court must hold a hearing to determine whether the disclosure statement should be approved. Acceptance or rejection of a Chapter 11 Plan usually cannot be solicited until the court has first approved the written disclosure statement. An exception to this rule exists if the initial solicitation of the party occurred before the bankruptcy filing, as would be the case in a prepackaged bankruptcy plan. Once the bankruptcy court approves the disclosure statement, the disclosure statement and the Chapter 11 Plan are sent out for a vote to those creditors and interest holders entitled to vote.

Under Section 1126(c) of the Bankruptcy Code, an entire class of claims is deemed to accept a plan if the Chapter 11 Plan is accepted by creditors that hold at lease two-thirds in amount and more than one-half in number of the allowed claims in the class. Under Section 1129(a)(10) of the Bankruptcy Code, if there are impaired classes of claims, the court cannot confirm a Chapter 11 Plan unless it has been accepted by at least one class of non-insiders who hold impaired claims (i.e., claims that are not going to be paid completely or in which some legal, equitable or contractual right is altered). Moreover, pursuant to Section 1126(f) of the Bankruptcy Code, holders of unimpaired claims are deemed to have accepted the Chapter 11 Plan. If the requisite number of votes to accept the Chapter 11 Plan are received, after notice, the Bankruptcy Court will hold a confirmation of the Chapter 11 Plan.

The court must be satisfied that there has been compliance with all other requirements of confirmation set forth in Section 1129 of the Bankruptcy Code and in order to confirm the Chapter 11 Plan, must find, among other things, that the Chapter 11 Plan (1) is feasible; (2) is proposed in good faith; and (3) is, together with the proponent of the plan, in compliance with the Bankruptcy Code. To satisfy the feasibility requirement, the court must find that confirmation of the Chapter 11 Plan is not likely to be followed by liquidation (unless the Chapter 11 Plan is a liquidating plan) or the need for further financial reorganization.

Under Section 1126(c) of the Bankruptcy Code, an entire class of claims is deemed to accept a plan if the Chapter 11 Plan is accepted by creditors that hold at lease two-thirds in amount and more than one-half in number of the allowed claims in the class. Under Section 1129(a)(10) of the Bankruptcy Code, if there are impaired classes of claims, the court cannot confirm a Chapter 11 Plan unless it has been accepted by at least one class of non-insiders who hold impaired claims (i.e., claims that are not going to be paid completely or in which some legal, equitable or contractual right is altered). Moreover, pursuant to Section 1126(f) of the Bankruptcy Code, holders of unimpaired claims are deemed to have accepted the Chapter 11 Plan. If the requisite number of votes to accept the Chapter 11 Plan are received, after notice, the Bankruptcy Court will hold a confirmation of the Chapter 11 Plan.

The court must be satisfied that there has been compliance with all other requirements of confirmation set forth in Section 1129 of the Bankruptcy Code and in order to confirm the Chapter 11 Plan, must find, among other things, that the Chapter 11 Plan (1) is feasible; (2) is proposed in good faith; and (3) is, together with the proponent of the plan, in compliance with the Bankruptcy Code. To satisfy the feasibility requirement, the court must find that confirmation of the Chapter 11 Plan is not likely to be followed by liquidation (unless the Chapter 11 Plan is a liquidating plan) or the need for further financial reorganization.

DISCHARGE

BUSINESS DEBTORS:

Confirmation of a Chapter 11 Plan discharges a debtor from any debt that arose before the date of confirmation. After the Chapter 11 Plan is confirmed, the debtor is required to make Chapter 11 Plan payments and is bound by the Chapter 11 Plan. The confirmed Chapter 11 Plan creates new contractual rights, replacing or superseding pre-bankruptcy contracts.

INDIVIDUAL DEBTORS:

Confirmation of a Chapter 11 Plan DOES NOT discharge an individual debtor from any debt made nondischargeable by Section 523 of the Bankruptcy Code. Except in limited circumstances, a discharge is not available to an individual debtor unless and until all payments have been made under the Chapter 11 Plan. The individual debtor will also be required to complete an approved mandatory debtor education and financial management course and file a certificate of completion with the court.

Confirmation of a Chapter 11 Plan discharges a debtor from any debt that arose before the date of confirmation. After the Chapter 11 Plan is confirmed, the debtor is required to make Chapter 11 Plan payments and is bound by the Chapter 11 Plan. The confirmed Chapter 11 Plan creates new contractual rights, replacing or superseding pre-bankruptcy contracts.

INDIVIDUAL DEBTORS:

Confirmation of a Chapter 11 Plan DOES NOT discharge an individual debtor from any debt made nondischargeable by Section 523 of the Bankruptcy Code. Except in limited circumstances, a discharge is not available to an individual debtor unless and until all payments have been made under the Chapter 11 Plan. The individual debtor will also be required to complete an approved mandatory debtor education and financial management course and file a certificate of completion with the court.

MANDATORY POST-FILING DEBTOR EDUCATION AND FINANCIAL MANAGEMENT COURSE (FOR INDIVIDUAL DEBTORS ONLY)

For an individual debtor, to receive a discharge in a Chapter 11 bankruptcy, all debtors are required to take an approved education course, the goal of which is to educate you on making wise financial choices including budget preparation; money management; utilizing credit wisely and effectively; consumer protection laws and agencies; and dealing with unexpected financial difficulties. Please note that this debtor education and financial management course is in addition to the pre-bankruptcy credit counseling course you took prior to filing your bankruptcy petition.

We recommend the second course offered by DebtorEdu or Access Counseling, Inc., each of which can be accessed by clicking on the respective logo below.

We recommend the second course offered by DebtorEdu or Access Counseling, Inc., each of which can be accessed by clicking on the respective logo below.

If you prefer to take a different course, please navigate to U.S. Department of Justice | U.S. Trustee's Office | List of Approved Providers of Personal Financial Management Instructional Courses by clicking on the logo below.

Upon completion of your debtor education and financial management course, please provide your certificate of completion to us for filing with the bankruptcy court.

Upon completion of your debtor education and financial management course, please provide your certificate of completion to us for filing with the bankruptcy court.

DEBTOR-IN-POSSESSION OPERATING GUIDELINES

While this summarizes the general requirements for a debtor-in-possession, it is not exhaustive and certain situations may need to be addressed on a case-by-case basis. Accordingly, you should consult with your attorney at Tran Singh LLP whenever you have questions.

A debtor-in-possession acts in a fiduciary and managerial role and is authorized only to carry out those functions that are in the ordinary course of business within the meaning of the Bankruptcy Code. The following are general guidelines that we recommend you refer to throughout your Chapter 11 bankruptcy:

1. Fully and timely pay all debts arising after the Chapter 11 case was filed ("post-petition"). This includes not only general business expenses, but all post-petition obligations including, but not limited to:

2. The debtor is prohibited from paying pre-petition obligations except as allowed by the Bankruptcy Code or by an order of the Bankruptcy Court.

3. The debtor shall file all federal, state and local tax returns when due, or shall obtain an extension from the appropriate taxing authority, unless otherwise provided by the Bankruptcy Code or by an order of the Bankruptcy Court. All post-petition taxes shall be timely paid.

4. No assets may be sold or disposed of, other than in the ordinary course of business, except as allowed by and in compliance with Section 363 of the Bankruptcy Code and the Federal Rules of Bankruptcy Procedure governing sales. If there are ANY doubts as to whether a particular transaction is outside the ordinary course of the debtor's business, counsel should be consulted prior to commencement of any action on that transaction. Generally, it is more prudent to seek court approval whenever there is a transaction that could be deemed to fall outside the ordinary course of business.

5. The debtor may not pay any professionals without an order of the Bankruptcy Court. Applications for employment of professionals must be submitted to and approved by the court before the professionals render any services to the debtor. Further, applications for compensation of professionals must be submitted to and approved by an order of the Bankruptcy Court before the debtor pays the professionals.

6. In accordance with Section 363(c)(2) of the Bankruptcy Code, the debtor may not use cash collateral without the consent of the secured creditor or the approval of the Bankruptcy Court. Any application for use of cash collateral or approval of a cash collateral agreement must comply with Federal Rules of Bankruptcy Procedure 4001.

7. The debtor may not obtain credit or incur secured or unsecured debt other than in the ordinary course of business. The debtor must comply with Section 364 of the Bankruptcy Code and Federal Rules of Bankruptcy Procedure 4001.

8. The debtor must provide the U.S. Trustee with a current and fully accurate address and phone number of the debtor and responsible individual, debtor's counsel and debtor's responsible financial individual. Any change of address or telephone number must be reported to the U.S. Trustee immediately.

A debtor-in-possession acts in a fiduciary and managerial role and is authorized only to carry out those functions that are in the ordinary course of business within the meaning of the Bankruptcy Code. The following are general guidelines that we recommend you refer to throughout your Chapter 11 bankruptcy:

1. Fully and timely pay all debts arising after the Chapter 11 case was filed ("post-petition"). This includes not only general business expenses, but all post-petition obligations including, but not limited to:

- Wages

- FICA, both employee and employer share

- Tax deposits withheld from wages

- Federal and state employment taxes

- Sales tax

- U.S. Quarterly Fees

- Any other taxes (i.e., ad valorem, property, etc.)

2. The debtor is prohibited from paying pre-petition obligations except as allowed by the Bankruptcy Code or by an order of the Bankruptcy Court.

3. The debtor shall file all federal, state and local tax returns when due, or shall obtain an extension from the appropriate taxing authority, unless otherwise provided by the Bankruptcy Code or by an order of the Bankruptcy Court. All post-petition taxes shall be timely paid.

4. No assets may be sold or disposed of, other than in the ordinary course of business, except as allowed by and in compliance with Section 363 of the Bankruptcy Code and the Federal Rules of Bankruptcy Procedure governing sales. If there are ANY doubts as to whether a particular transaction is outside the ordinary course of the debtor's business, counsel should be consulted prior to commencement of any action on that transaction. Generally, it is more prudent to seek court approval whenever there is a transaction that could be deemed to fall outside the ordinary course of business.

5. The debtor may not pay any professionals without an order of the Bankruptcy Court. Applications for employment of professionals must be submitted to and approved by the court before the professionals render any services to the debtor. Further, applications for compensation of professionals must be submitted to and approved by an order of the Bankruptcy Court before the debtor pays the professionals.

6. In accordance with Section 363(c)(2) of the Bankruptcy Code, the debtor may not use cash collateral without the consent of the secured creditor or the approval of the Bankruptcy Court. Any application for use of cash collateral or approval of a cash collateral agreement must comply with Federal Rules of Bankruptcy Procedure 4001.

7. The debtor may not obtain credit or incur secured or unsecured debt other than in the ordinary course of business. The debtor must comply with Section 364 of the Bankruptcy Code and Federal Rules of Bankruptcy Procedure 4001.

8. The debtor must provide the U.S. Trustee with a current and fully accurate address and phone number of the debtor and responsible individual, debtor's counsel and debtor's responsible financial individual. Any change of address or telephone number must be reported to the U.S. Trustee immediately.

TRAN SINGH LLP

2502 La Branch Street | Houston, Texas 77004 | Phone: (832) 975-7300 | Fax: (832) 975-7301 | Email: [email protected]

DISCLAIMER AND LEGAL NOTICE

We are a debt relief agency. We help people file for relief under the Bankruptcy Code.

2502 La Branch Street | Houston, Texas 77004 | Phone: (832) 975-7300 | Fax: (832) 975-7301 | Email: [email protected]

DISCLAIMER AND LEGAL NOTICE

We are a debt relief agency. We help people file for relief under the Bankruptcy Code.